Weighing The Pros And Cons

When it comes to protecting your financial future, choosing the right insurance is crucial. Surest Insurance has gained popularity as a modern solution for health coverage, but is it the right choice for you? In this article, we will delve into the pros and cons of Surest Insurance, helping you make an informed decision.

The insurance landscape has shifted dramatically over the years, with innovative companies like Surest changing the way we think about health coverage. Unlike traditional insurance models, Surest offers a unique approach that emphasizes transparency and simplicity. However, understanding the intricacies of this insurance type is essential before committing.

This article will explore the key features of Surest Insurance, its advantages and disadvantages, and provide you with practical insights into whether it aligns with your healthcare needs. Let’s dive into the world of Surest Insurance and uncover its true value.

Table of Contents

What is Surest Insurance?

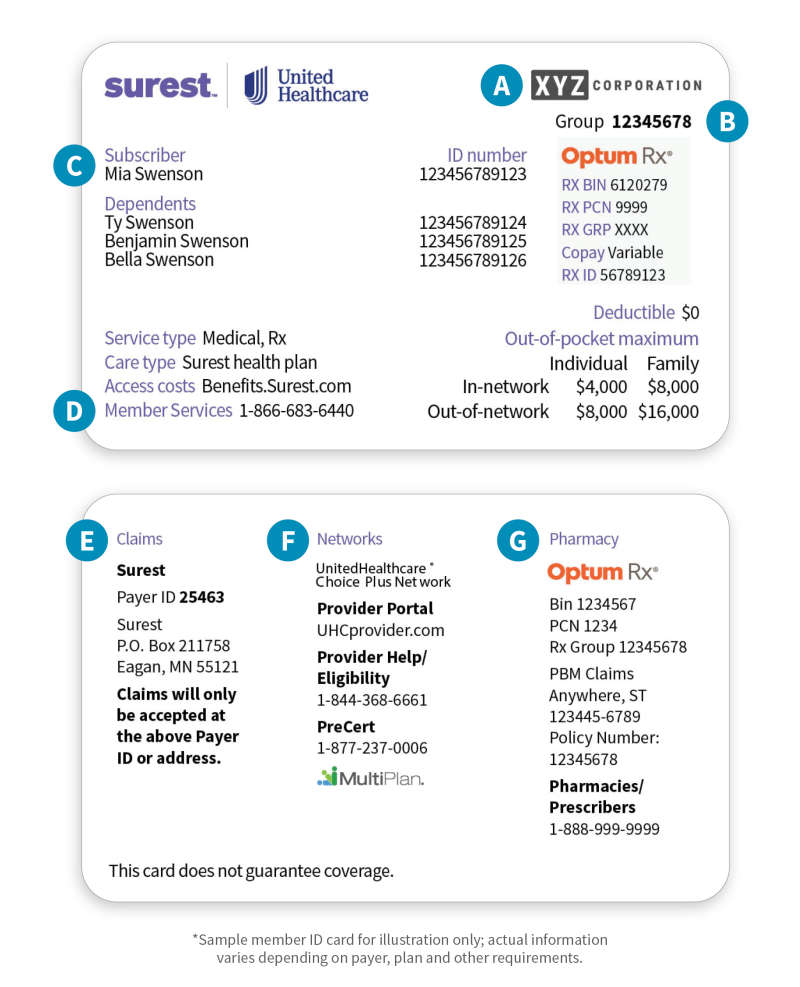

Surest Insurance is a health coverage option that aims to simplify the insurance process. Unlike traditional health insurance plans, which can often be complex and laden with hidden fees, Surest provides a straightforward approach. The company focuses on transparency, making it easier for individuals to understand their benefits and costs.

With Surest, members have access to a network of healthcare providers and can receive care without the burdens of high deductibles or unexpected out-of-pocket expenses. This insurance model is designed to prioritize both the health of its members and their financial well-being.

Pros of Surest Insurance

Understanding the advantages of Surest Insurance can help you determine if it’s the right choice for your healthcare needs. Here are some notable pros:

- Transparent Pricing: Surest Insurance offers clear pricing structures, enabling members to know what they will pay upfront for services.

- No Hidden Fees: Unlike traditional insurance, Surest aims to eliminate hidden costs, providing peace of mind to its users.

- Access to a Wide Network: Users can access a broad network of healthcare providers, ensuring they receive quality care when needed.

- Predictable Costs: Members benefit from predictable monthly costs, making budgeting for healthcare expenses easier.

Cons of Surest Insurance

While Surest Insurance has several advantages, it’s important to consider the potential drawbacks:

- Limited Coverage Options: Surest may not provide as many coverage options as traditional insurance plans, which could limit choices for some users.

- Not Available in All States: Availability of Surest Insurance varies by state, which may restrict access for some individuals.

- Potential for Higher Costs for Certain Services: Although pricing is transparent, some users may find that certain services are more costly compared to traditional plans.

- Lack of Comprehensive Dental and Vision Coverage: Surest may not offer comprehensive coverage for dental and vision services, which could be a downside for some individuals.

How Surest Insurance Works

Understanding how Surest Insurance operates is essential for potential members. Here’s a breakdown of its functionality:

- Enrollment: Individuals can enroll in Surest Insurance through their employer or directly through the company’s website.

- Choosing Providers: Members select from a network of healthcare providers, ensuring they receive care at transparent prices.

- Accessing Services: When seeking medical attention, members can easily access services without worrying about hidden fees.

- Managing Costs: Members can manage their healthcare costs through the Surest app, which helps track expenses and plan for future healthcare needs.

Who Should Consider Surest Insurance?

Surest Insurance may be an excellent fit for certain individuals. Here are some groups that should consider this insurance option:

- Individuals Seeking Simplicity: Those who want a straightforward insurance model without the complexities of traditional plans.

- Health-Conscious Individuals: People who prioritize preventive care and want predictable healthcare costs.

- Young Professionals: Young adults who may not require extensive coverage but still want to ensure they have access to necessary healthcare services.

- Employers Looking for Innovative Options: Companies that want to offer unique health benefits to their employees may consider Surest Insurance.

Comparing Surest Insurance with Traditional Insurance

To better understand Surest Insurance, it’s helpful to compare it with traditional insurance models:

Cost Structure

Traditional insurance often comes with high deductibles and unexpected out-of-pocket costs. In contrast, Surest offers predictable pricing, which can be more appealing to many users.

Coverage Options

While traditional insurance plans provide a wide array of coverage options, Surest may have limitations in certain areas, particularly regarding specialized services.

Customer Experiences and Reviews

Customer reviews can provide valuable insights into the effectiveness of Surest Insurance. Many users appreciate the transparency and ease of understanding their coverage. Positive feedback often highlights the simplicity of the enrollment process and the predictability of healthcare costs.

However, some customers have expressed concerns regarding the limited coverage options and the availability of services in certain areas. It’s essential to weigh these experiences when considering Surest Insurance.

Final Thoughts on Surest Insurance

In conclusion, Surest Insurance presents a modern approach to health coverage that emphasizes transparency and simplicity. While it offers several advantages, such as predictable costs and a user-friendly experience, potential drawbacks like limited coverage options should be carefully considered.

As you contemplate your insurance choices, take the time to evaluate your personal healthcare needs and financial situation. Consider leaving a comment below, sharing your thoughts on Surest Insurance, or exploring other articles on our site for more insights.

Conclusion

Choosing the right insurance is a significant decision that can impact your financial and physical well-being. By understanding the pros and cons of Surest Insurance, you can make an informed choice that aligns with your needs and preferences. We encourage you to explore further and stay informed about your insurance options.

Thank You for Reading!

We appreciate your time and hope this article helped clarify your understanding of Surest Insurance. Please consider returning to our site for more informative content and resources on health insurance and related topics.

ncG1vNJzZmivmaC2b7XSrJirrZKWe6S7zGikmrCemsS0g46srKudo6l6qrrSrqmappOaerG%2BzqxkmqaUYrCwutJnn62lnA%3D%3D